New Orleans officials are expressing frustration with Folgers Coffee Co. for refusing to pay its outstanding property taxes, which fund schools, police and a variety of critical services.

Nearly two years ago, the New Orleans City Council and Orleans Parish School Board both denied Folgers’ applications for tax exemptions. Nonetheless, the company still has not paid the taxes, and now it is arguing in court that it should never have to pay them. Civil District Judge Omar Mason will consider the matter at a hearing on Thursday (Nov. 17) at 10 a.m.

“Homeowners and small businesses have to pay their taxes. and so should Folgers. The law and the votes have been clear: They owe these taxes that pay for essential city services like public safety and infrastructure. No one should be exempt from the law,” said City Council President Helena Moreno.

“Everyone needs to play by the rules, no matter how many lawyers they can afford. The City Council denied Folger’s tax exemption applications, and so the company owes the taxes, plain and simple,” said City Council Vice President JP Morrell. “When it comes to our young people, public safety and city services, we need everyone doing their part, including paying the taxes they owe.”

City Councilmember Joe Giarrusso III, who chairs the Budget Committee, stated: “The City Council considered and denied Folgers’ request for a tax exemption. With inflation and rising costs, collecting outstanding taxes is critical to ensure the needs of all New Orleanians are being met.”

“Almost two years ago, the City Council unanimously rejected Folgers’ attempts to shirk its tax responsibilities. Folgers simply could not demonstrate that its properties in question generated new jobs, required for the City to grant industrial tax exemptions. It’s unfortunate that Folgers is continuing to fight the millions it owes in property taxes, given the importance of these dollars in funding criminal justice, youth programming and infrastructure initiatives. I earnestly hope the court works in the City’s best interest, so we can collect all that the City is due,” said City Councilmember Lesli Harris.

“While we want to respect the interest of our business and corporate partners, issues like this not only affect them, but our school system, recreation and public safety departments. We always must be mindful that, while we want our businesses to be successful, we need the taxes that they generate to take care of the services for our most needed residents who reside in our city,” said City Councilmember Oliver M. Thomas, Jr.

“The Sheriff’s Office, and our city’s public safety, depend on funding from property taxes. My office is looking to provide more competitive wages and fill critical staffing shortages; and every dollar counts. I hope the Folgers case is resolved soon and in the best interest of our community,” said Sheriff Susan Hutson.

“This tax revenue should be benefitting New Orleans students. Taxes like these increase teacher pay and provide high quality instruction and after-school activities for kids. Folgers should respect its legal responsibilities and fulfill its obligations to the children and families of New Orleans,” said Orleans Parish School Board President Olin Parker.

“A full two years ago, the School Board unanimously denied Folgers’ request to be exempt from paying the taxes it owes to the New Orleans Public Schools. Their continued refusal to pay their taxes is denying our schools and students of much-needed funding. It is an affront to the students and teachers of New Orleans. I look forward to this matter being resolved in the best interest of our students and families,” said Orleans Parish School Board Vice President Carlos Zervigon.

“Every penny counts when it comes to funding our schools, public safety and city services. That’s why it’s frustrating to see Folgers fighting to get out of paying what it owes after the City Council and School Board denied its tax exemption applications. Just like small businesses have to pay taxes, so do the big ones. I hope this matter is resolved quickly and in the best interests of the people,”said State Representative Jason Hughes.

“There’s a lot of talk of supporting our teachers and students, but too few put their money where their mouth is. The millions of dollars Folgers owes in property taxes are critical to our schools. We’re calling on the multi-billion dollar corporation to do what’s right and pay what it owes,” said President of United Teachers of New Orleans Dave Cash.

The conflict stems from the controversial Industrial Tax Exemption Program (ITEP), which was reformed in 2016 by Gov. John Bel Edwards to give local governments a direct say in whether their property taxes are exempted.

“This is exactly what it looks like: a massive out-of-state company doing whatever it takes to avoid paying their legal obligation of New Orleans taxes,” said Pastor Duane Gidney, a clergy leader with Together New Orleans, a citizens’ group that is party to the lawsuit and advocated for the ITEP reforms. “Restoring local control over tax incentives has delivered a lot more money to our schools and services. And Folgers’ refusing to pay what it owes isn’t fair to kids, teachers, or anyone in our community.

“I have to pay my property taxes. I want Folgers to fulfill their legal obligation as well to our schools and city services,” he continued.

Background

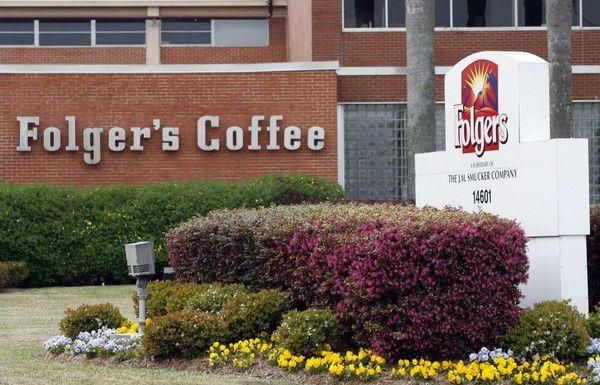

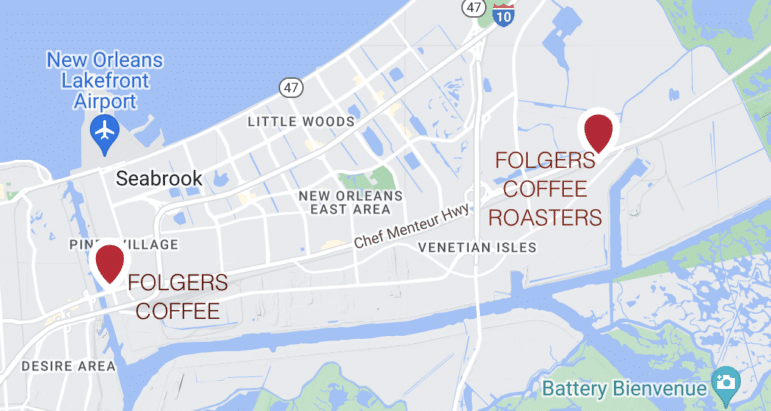

In December 2020 and January 2021, the Orleans Parish School Board and New Orleans City Council voted unanimously to deny six Industrial Tax Exemption Program (ITEP) applications filed by The Folgers Coffee Company. In so doing, these bodies elected to keep $225 million in Folgers’ business property on the tax rolls, yielding roughly $5 million of additional tax revenue per year.

Once the applications were rejected, Folgers was obligated to pay property taxes like all other residential and commercial property owners in New Orleans.

Folgers owes approximately $9.6 million in taxes on these properties: $4.9 million in back taxes from 2019-2021 and $4.7 million in 2022 taxes.

Folgers’ Ohio-based parent company J.M. Smuckers earned more than $875 million dollars in profits in 2021 on over $8 billion dollars in revenue.

Together New Orleans

2721 S. Broad St.

contact@togetherla.org